A Few Steps to Get Started for How to Invest in Nifty Bees

How to Invest in Nifty Bees

If you’re looking to invest in Nifty Bees, but don’t know where to start, I’ve got you covered. In this article, I’ll walk you through a few simple steps that will help you get started on your investment journey. Whether you’re a beginner or an experienced investor, these steps will provide you with the necessary foundation to confidently invest in Nifty Bees.

The first step is understanding what Nifty Bees actually are. Nifty Bees are exchange-traded funds (ETFs) that track the performance of the Nifty 50 index. This index represents the top 50 companies listed on the National Stock Exchange (NSE) of India. By investing in Nifty Bees, you can gain exposure to a diversified portfolio of leading Indian companies and potentially benefit from their growth.

A Beginner’s Guide

If you’re new to the world of investing and looking to dip your toes into the stock market, Nifty Bees can be a great starting point. But what exactly are Nifty Bees? In this beginner’s guide, I’ll walk you through the basics and provide a few steps to get started on your journey of investing in Nifty Bees.

- What are Nifty Bees? Nifty Bees, short for NSE’s Benchmark Exchange Traded Scheme, is an exchange-traded fund (ETF) that aims to replicate the performance of the National Stock Exchange’s benchmark index – the Nifty 50. It offers investors an opportunity to invest in a diversified portfolio of 50 large-cap Indian companies across various sectors.

- Understanding how they work Nifty Bees function like any other ETF. They are listed and traded on the stock exchange just like individual stocks. By buying units of Nifty Bees, investors indirectly own a proportionate share in all 50 stocks that make up the index. This provides them with exposure to a wide range of companies without having to buy each one individually.

- Benefits of investing in Nifty Bees Investing in Nifty Bees has several advantages for beginners:

- Diversification: As mentioned earlier, owning units of Nifty Bees gives you exposure to a diverse range of stocks from different sectors, reducing risk.

- Cost-effective: Since you’re investing in an ETF rather than buying individual stocks, transaction costs are generally lower.

- Liquidity: Being listed on the stock exchange means that buying or selling units can be done easily during market hours at prevailing market prices.

- Transparency: The constituents and their weightage within the index are publicly available information, ensuring transparency for investors.

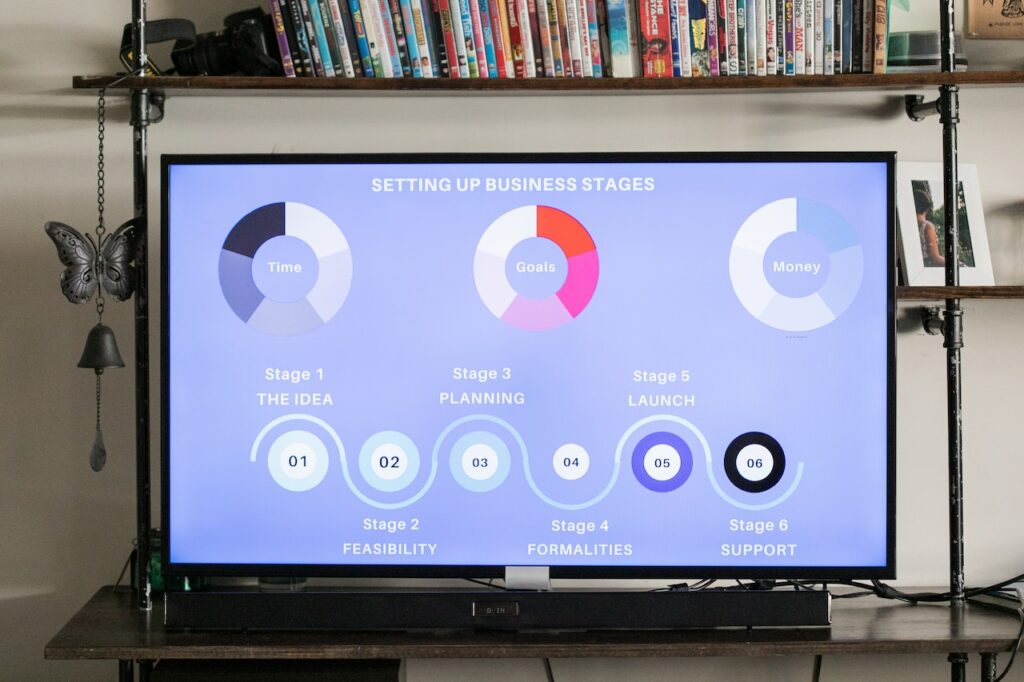

- Steps to get started Now that we’ve covered some basics about Nifty Bees, here are a few steps to help you get started:

a. Open a Demat and trading account: To invest in Nifty Bees or any other ETF, you’ll need a Demat and trading account with a registered stockbroker.

b. Research and select the right Nifty Bees: Before investing, analyze the performance, expense ratio, liquidity, and other factors of different Nifty Bees available in the market. Choose one that aligns with your investment goals.

c. Place an order through your broker: Once you’ve selected the desired Nifty Bees, place an order to buy units through your stockbroker’s online trading platform or by contacting their customer service desk.

d. Monitor your investments: Keep track of how your investment in Nifty Bees is performing over time. Stay informed about any changes to the index constituents or market conditions that may impact its value.

Remember, investing involves risks, and it’s essential to do thorough research and consult with a financial advisor if needed before making any investment decisions.

Choosing the Right Brokerage for Nifty Bees Investment

When it comes to investing in Nifty Bees, one crucial step is selecting the right brokerage. The brokerage you choose can greatly impact your investment experience and potential returns. Let’s delve into a few key factors to consider when making this important decision:

- Research the Reputation: Before committing to a brokerage, take some time to research its reputation in the market. Look for evaluations and feedback from other investors who have used their services. A reputable brokerage will have a track record of providing reliable and efficient services, ensuring that your investments are handled with care.

- Cost and Fees: Another vital aspect to evaluate is the cost structure and fees associated with the brokerage. Different brokerages may have varying fee structures, including account opening charges, transaction fees, annual maintenance charges, and more. It’s essential to understand these costs upfront so that they do not eat into your potential earnings.

- Trading Platform: Consider the trading platform provided by the brokerage. A user-friendly platform with intuitive navigation can make your investment journey smoother and more enjoyable. Look for features such as real-time market data, technical analysis tools, mobile accessibility, and ease of order placement.