How to Invest in McDonalds: A Lucrative Opportunity

If you’re considering investing in McDonald’s, you may be wondering how to get started. Investing in this renowned fast food chain can be a lucrative opportunity for those looking to diversify their portfolio. In this article, I’ll guide you through the process of investing in McDonald’s and provide some valuable insights along the way.

First and foremost, it’s important to understand that there are different ways to invest in McDonald’s. One option is to purchase individual shares of the company’s stock through a brokerage account. This allows you to directly own a portion of the company and potentially benefit from its growth and dividends.

Another option is investing indirectly through mutual funds or exchange-traded funds (ETFs) that include McDonald’s as part of their portfolio. This approach provides diversification across multiple companies while still giving you exposure to McDonald’s performance.

How To Invest In Mcdonalds

The Financial Performance of McDonald’s

When considering investing in any company, one crucial aspect to evaluate is its financial performance. In the case of McDonald’s, it has consistently demonstrated strong financial results, making it an attractive investment option. Here are a few key points to consider:

- Steady Revenue Growth: Over the years, McDonald’s has managed to sustain and even grow its revenue despite economic fluctuations and changes in consumer preferences. This stability is primarily due to its globally recognized brand and wide customer base.

- Profitability: McDonald’s has consistently generated healthy profits, showcasing its ability to effectively manage costs while maintaining competitive pricing structures. This profitability can be attributed to their efficient supply chain management and effective marketing strategies.

- Dividend Payments: For income-oriented investors, McDonald’s offers an added incentive through regular dividend payments. These consistent payouts reflect the company’s commitment to returning value to shareholders.

- Shareholder Returns: Investing in McDonald’s has historically provided solid returns for shareholders over the long term. The combination of share price appreciation and dividends contributes significantly to the total return on investment.

The Competitive Advantage of McDonald’s

One of the primary reasons why investors should consider putting their money into McDonald’s is because of its formidable competitive advantage within the fast food industry.

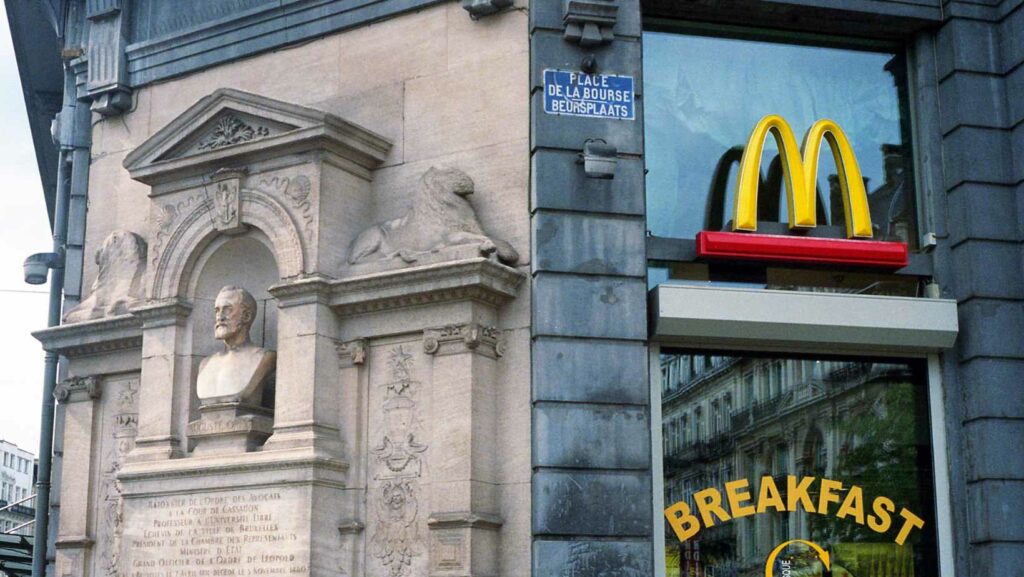

- Global Brand Recognition: With over 37,000 locations across more than 100 countries, McDonald’s enjoys unparalleled brand recognition worldwide. This extensive reach ensures a steady flow of customers and provides a significant barrier for new entrants attempting to compete at such scale.

- Strong Franchise Model: Approximately 90% of all McDonald’s restaurants are owned by franchisees rather than being directly operated by the company itself. This franchise model allows for rapid expansion without bearing all associated costs and risks entirely on corporate shoulders.

- Continuous Innovation: Despite being a well-established brand, McDonald’s has consistently adapted to changing consumer demands. By introducing healthier menu options, embracing digital technology for ordering and delivery, and exploring sustainability initiatives, McDonald’s remains relevant in an evolving market.

Investment Opportunities in The Fast Food Industry

Investing in McDonald’s offers exposure not only to its own financial success but also to broader opportunities within the fast food industry.

- Market Growth Potential: The fast food industry continues to expand globally as emerging markets experience increasing disposable incomes and urbanization. This growth potential presents ample investment opportunities beyond just McDonald’s itself.

- Diversification: Investing in a well-known brand like McDonald’s provides diversification within the consumer discretionary sector. By including a variety of companies from this sector in your investment portfolio, you can spread risk across multiple businesses while capitalizing on their collective growth potential.

- Resilience During Economic Downturns: Fast food chains have historically demonstrated resilience during economic downturns due to their affordability and value proposition for customers seeking convenient dining options at lower price points.

Market Volatility and Economic Conditions

Investing in any company involves exposure to market volatility and economic conditions. While McDonald’s has demonstrated resilience over the years, it is not immune to fluctuations in the global economy. Economic downturns can impact consumer spending habits and ultimately affect fast-food chains like McDonald’s.

Additionally, changes in consumer preferences and dietary trends could impact sales growth. As healthier alternatives gain popularity or new food fads emerge, McDonald’s must adapt its menu offerings accordingly to maintain customer loyalty.

Dependence on Franchisees

McDonald’s operates through a combination of company-owned restaurants and franchised locations. While this franchise model offers advantages such as reduced capital expenditure for expansion, it also poses certain risks.

The success of McDonald’s is dependent on the performance and management capabilities of its franchisees. Issues such as franchisee disputes, financial instability, or operational shortcomings at specific locations could have an adverse impact on the overall brand image and financial performance.