Navigating Financial Challenges: Strategies for Overcoming Bad Credit

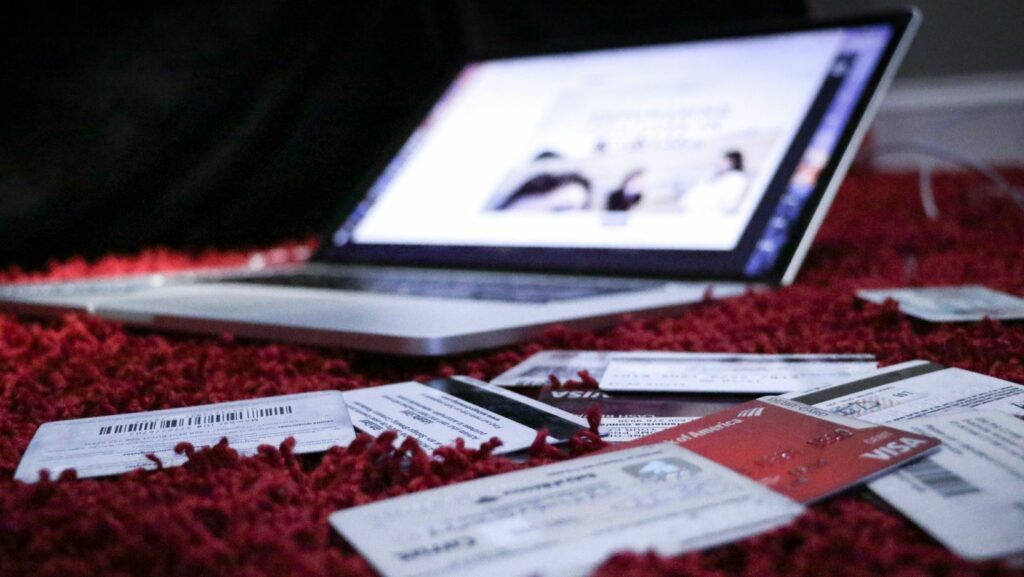

Bad credit can feel like a heavy chain that restrains your financial freedom. It’s a daunting challenge, but don’t despair! With the right strategies, you can overcome this obstacle and start rebuilding your financial health.

In this article, I’ll share practical tips and strategies to help you navigate the murky waters of bad credit. You’ll learn how to turn your financial situation around and regain control of your economic destiny.

So, let’s roll up our sleeves and dive into the world of credit scores, debt management, and smart financial planning. It’s time to break free from the shackles of bad credit and step into a future of financial stability and freedom.

Understanding Bad Credit

Delving into bad credit, it’s crucial to assess its impact on your financial status and understand common causes that lead to its occurrence.

The Impact of Bad Credit on Your Finances

Experiencing bad credit takes a toll on your finances in a myriad of ways. For instance, it restricts your access to affordable credit, influencing your ability to qualify for loans like personal loans or even debt consolidation options. Employers and landlords might take a peek at your credit report, so a bad credit score can potentially impact job and housing prospects. Moreover, bad credit could lead to higher insurance premiums. In essence, your entire financial well-being is at risk.

Common Reasons for Bad Credit

Several factors contribute to bad credit. It typically originates from mistakes that negatively impact your credit score. Missed payments, collection accounts, high credit utilisation, and past due bills are common culprits. Furthermore, bankruptcy and foreclosures can significantly damage your credit score. It’s important to remain vigilant about these potential pitfalls to have a clear understanding of overcoming bad credit. Despite these challenges, look beyond the horizon. To maximize the benefits of a bad credit loan, ensure that you borrow only what you need and can afford to repay.

Financial Challenges Associated with Bad Credit

Bad credit is more than just a number; it presents a multitude of financial obstacles that may inhibit progress towards financial stability. In the section below, I’ll detail some of these challenges.

Difficulty in Loan Approval

One significant hurdle associated with bad credit is the process of loan approval. Lenders and financial institutions often look at credit history as a measure of your financial reliability.

For instance, overcoming bad credit contains errors that can negatively impact your credit score. A bad credit score is a red flag for lenders, often leading to loan application rejections. Even initiatives like Debt consolidation personal loans become harder to secure when you have a poor credit score.

High-Interest Rates

Even if you manage to secure a loan with a poor credit score, it’s not usually smooth sailing. High interest rates are another challenge you’re likely to face. Lenders might compensate for the risk involved in lending to someone with bad credit by charging higher interest rates. For example, the benefits of a bad credit loan might be overshadowed by exceedingly high interest, complicating the repayment process and increasing the overall debt.

The Burden of Security Deposits

Lastly, if your credit score is on the lower end of the spectrum, you might notice that security deposits become a more frequent demand. Service providers such as utility companies and landlords often require substantial security deposits from those with bad credit. This up-front cost can create a further financial burden, making it even harder to get back on your feet financially.

Strategies to Overcome Bad Credit

Let’s delve into effective strategies that enable overcoming bad credit. Implementing these tactics can boost credit scores, paving the way for an improved financial outlook.

Understanding Your Credit Report

Keeping tabs on your credit report’s status is the first step towards recovering from bad credit. Remember, these reports contain mistakes that negatively impact your credit score.

A comprehensive analysis of this document uncovers the specific factors leading to low scores, offering a clear picture of the corrective measures required. Credit reporting companies provide a free annual report, making it easy to stay informed about your finances.

Prioritizing Debt Repayment

Aiming for a debt-free status adds a significant boost to credit scores. Debt consolidation personal loans are an excellent strategy for this purpose, combining multiple debts into a single, manageable debt with lower interest rates. Current debts take the front seat in the repayment queue, with the strategy placing emphasis on debts with higher interest rates. Thus, being vigilant about repayment schedules aids in surpassing bad credit challenges.

Establishing a Regular Payment History

To maximize the benefits of a bad credit loan, ensure that you borrow only what you need and can afford to repay. Create a budget to manage your loan payments alongside other financial obligations. Consistently making on-time payments will reflect positively on your credit report, gradually boosting your score.