5 Ways Online Loans Are Changing How We Manage Emergencies

Medical bills, urgent repairs, or unexpected travel costs can leave people searching for immediate solutions. Unfortunately, traditional loans or credit options often involve long waiting periods and stringent approval processes, making them less practical during urgent situations.

The good news is that online loans have transformed how people respond to such financial challenges. Their speed, accessibility, and convenience make them a practical option for managing emergencies. Since they’re processed “online,” applicants can request and get funds almost instantly with just a few clicks.

Faster Access to Funds

Most money loans online bypass the lengthy paperwork associated with traditional loans. Their applications are usually completed on a smartphone or computer, with approvals sometimes arriving within hours.

This level of speed ensures that pressing financial needs, like urgent car repairs or immediate medical expenses, can be handled quickly. Its user-friendly nature allows people to focus on resolving their emergencies instead of stressing over funding delays. However, this convenience requires responsible borrowing.

Borrowers should carefully review terms and conditions to avoid hidden fees. Setting aside time to verify a lender’s legitimacy can prevent falling victim to scams or fraud.

Accessibility for All

Online loans have widened financial access, especially for individuals struggling to secure traditional loans. Many online lenders consider alternative factors when assessing eligibility, making it possible for more people to qualify.

This approach is particularly beneficial for self-employed, freelancers, or part-time workers. It provides a lifeline for financial emergencies, removing barriers that might have previously left some without options.

Despite this increased accessibility, borrowers must remain cautious. It’s essential to choose lenders that provide clear terms and prioritize transparency. Reading reviews and seeking advice from professionals can help in identifying trustworthy options.

Flexible Repayment Options

Online loans often come with flexible repayment terms, which allow borrowers to tailor payments to fit their financial circumstances. This adaptability can make managing an emergency less overwhelming, as individuals can choose plans that suit their income and expenses.

Having flexible repayment terms can reduce the stress of borrowing. This ensures people can focus on addressing their immediate needs rather than worrying about rigid deadlines. Many platforms also offer tools to track payments and set reminders, which adds to the overall convenience.

To maximize this feature, borrowers should avoid overcommitting to unrealistic repayment plans. Assessing personal finances before agreeing to terms is essential. If uncertainty arises, speaking with a financial advisor can offer clarity and guidance.

Greater Transparency in Loan Terms

Many online lenders provide clear breakdowns of loan terms, which help borrowers understand precisely what they agree to before committing. This transparency gives people the confidence to make informed decisions during stressful situations.

Access to clear information about fees and repayment schedules reduces the likelihood of surprises later on. Borrowers can compare options and select those that align with their needs. This control is especially valuable during emergencies when financial decisions must be made quickly.

It’s important, however, to verify all details before signing an agreement. Reading the fine print and asking questions can save borrowers from potential misunderstandings. If unsure, consulting with a professional is always a wise choice.

Availability of Small Loan Amounts

Unlike traditional loans that often require large minimum amounts, many online lenders allow borrowers to request smaller sums. This flexibility ensures that people can access the exact amount needed to handle emergencies without overextending their finances.

Requesting smaller amounts can be helpful for situations like replacing a broken appliance or covering minor medical expenses. Smaller loans are easier to repay, helping to ease the financial strain over time.

Even with smaller loans, due diligence is key. Choosing a reliable lender and staying within realistic borrowing limits is essential. If managing repayment becomes challenging, reaching out to the lender for potential solutions can prevent further issues.

The Importance of Responsible Borrowing

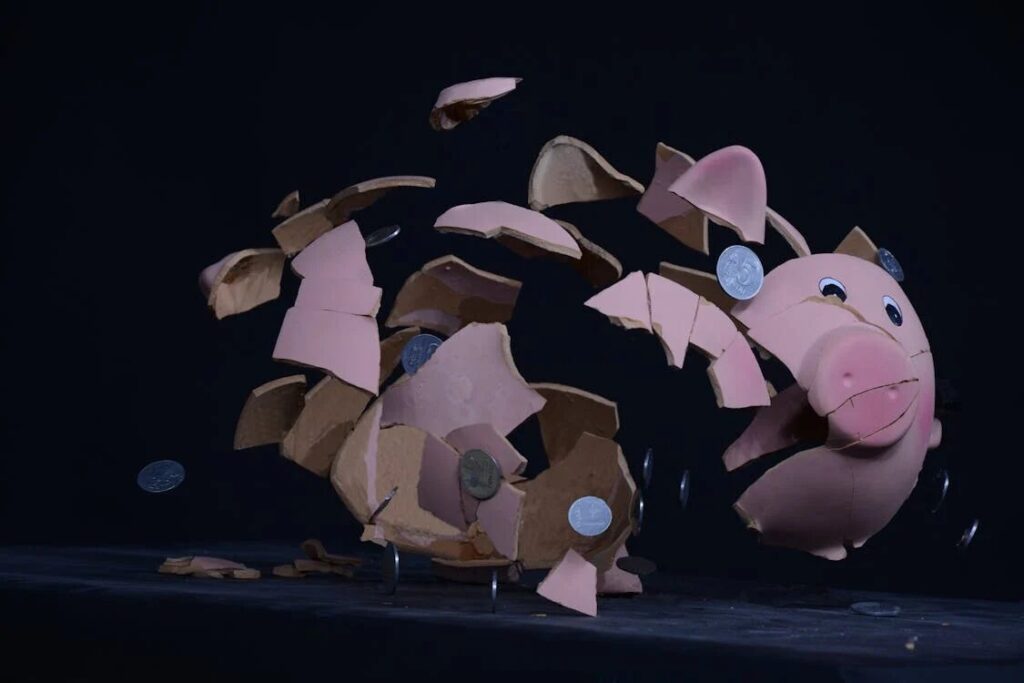

While online loans have transformed the way people manage emergencies, they also come with the responsibility of using them wisely. The ease of withdrawing funds can lead to over-borrowing, especially if individuals don’t consider their ability to repay.

Responsible borrowing involves taking only what is necessary and ensuring that repayment terms are manageable. This helps avoid unnecessary financial strain while ensuring the loan serves its purpose effectively. Irresponsible borrowing, in contrast, can lead to a cycle of debt, which becomes difficult to manage.

Reviewing loan agreements, understanding fees, and seeking advice from financial professionals are key steps to staying on track and using loans to handle emergencies responsibly. Additionally, many online platforms provide tools like repayment reminders and budgeting resources to support borrowers in making informed choices.

Managing Emergencies Through Online Loans

Online loans have become a valuable tool for managing emergencies, offering speed, convenience, and accessibility. They allow individuals to handle unexpected expenses with greater ease.

While they provide significant benefits, responsible borrowing is crucial. For anyone uncertain about their options or needing guidance, seeking professional help can ensure the best financial decisions are made.