Purchasing How To Invest In Rare Earth Metals

If you’re considering investing in rare earth metals, you’ve come to the right place. In this article, I’ll provide a comprehensive guide on how to make informed purchasing decisions in this unique market. Rare earth metals have gained significant attention due to their crucial role in various industries, including technology and renewable energy. Understanding the intricacies of investing in these valuable resources can potentially yield substantial returns.

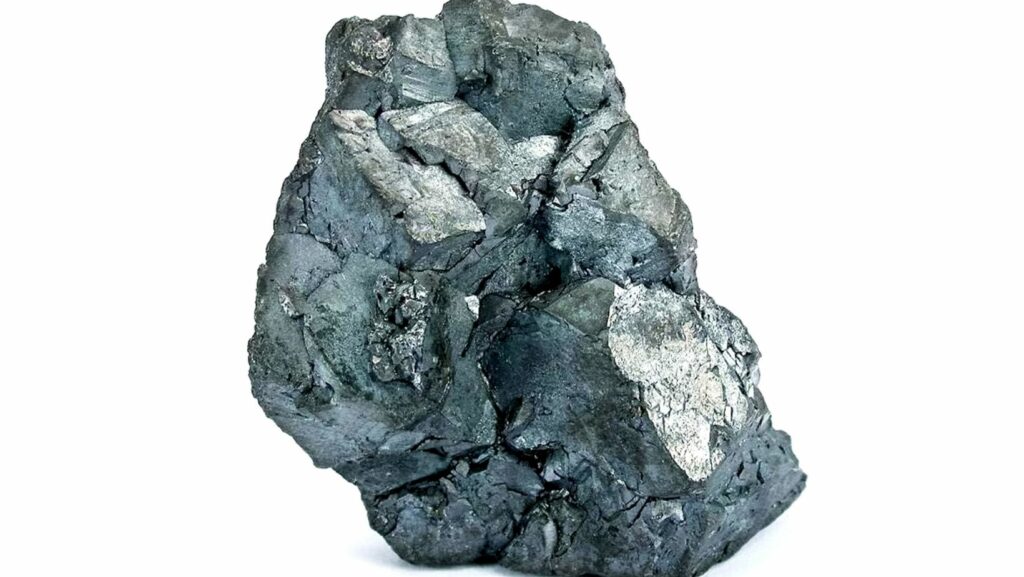

To start off, it’s important to grasp the basics of rare earth metals. These elements encompass a group of seventeen chemical elements with diverse properties and applications. From neodymium used in magnets for electric vehicles to lanthanum utilized in energy-efficient lighting, each metal plays a vital role in modern technologies. However, before diving into the investment aspect, it’s crucial to conduct thorough research on individual metals’ supply and demand dynamics, geopolitical factors affecting their availability, and potential market risks.

When it comes to purchasing rare earth metals as an investment, there are several avenues available. One option is buying physical stocks of these elements directly from reputable dealers or specialized companies dealing with precious metals. Alternatively, exchange-traded funds (ETFs) focused on rare earth metals offer investors exposure without the need for physical ownership. It’s essential to weigh the advantages and disadvantages of each approach carefully.

How To Invest In Rare Earth Metals

Understanding the Value of Rare Earth Metals

Rare earth metals are a group of 17 elements that possess unique properties and play a vital role in various industries. Despite their name, rare earth metals are not actually rare in terms of abundance, but they are widely dispersed and challenging to extract economically. These elements include cerium, dysprosium, erbium, gadolinium, holmium, lanthanum, lutetium, neodymium, praseodymium, promethium, samarium, scandium, terbium, thulium, ytterbium

Why Should You Consider Investing in Rare Earth Metals?

The Potential for Growth in Rare Earth Metal Investments

Investing in rare earth metals can offer significant potential for growth and profitability. These unique elements, which include seventeen chemically similar elements such as neodymium, cerium, and lanthanum, play a crucial role in various industries like technology, renewable energy, and defense.

One of the primary drivers behind the growth potential of rare earth metal investments is the increasing demand for emerging technologies. As advancements continue to be made in areas such as electric vehicles (EVs), wind turbines, and smartphones, the need for these metals intensifies. For instance, neodymium is a key component in the production of powerful magnets used in EV motors. With the global push towards sustainable energy solutions and technological innovation, rare earth metals are poised to become even more valuable.

Understanding the Market for Rare Earth Metals

Factors to Consider Before Investing

When it comes to investing in rare earth metals, there are several factors that potential investors should consider. These factors can greatly influence the profitability and success of their investments. One crucial factor is the global demand for rare earth metals, which is driven by various industries such as electronics, renewable energy, and defense.

Another important consideration is the supply chain dynamics of rare earth metals. These elements are primarily mined in a few countries, with China being the dominant producer. Any disruptions in the supply chain or changes in export policies can significantly impact prices and availability in the market.

Market Analysis and Forecasting

To make informed investment decisions, it’s essential to stay up-to-date with market analysis and forecasting for rare earth metals. This involves monitoring trends, understanding industry dynamics, and analyzing historical data.

Market analysis helps identify patterns and predict future price movements based on factors such as supply and demand dynamics, technological advancements, political developments, and economic conditions. By keeping track of these variables, investors can gain valuable insights into when to buy or sell their holdings.

Forecasting models utilize statistical techniques to project future price movements based on historical patterns and quantitative data. While no forecast can guarantee accuracy due to market volatility, these models provide a useful framework for making informed investment decisions.